Latest Version

10.43.6

September 02, 2024

Paytm - One97 Communications Ltd.

Finance

Android

2

Free

net.one97.paytm

Report a Problem

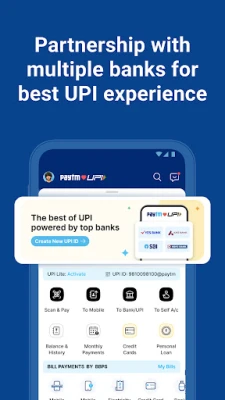

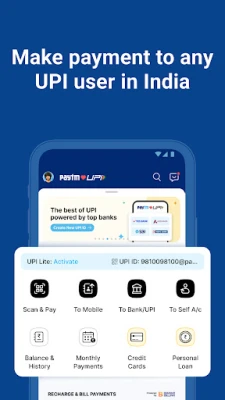

More About Paytm: Secure UPI Payments

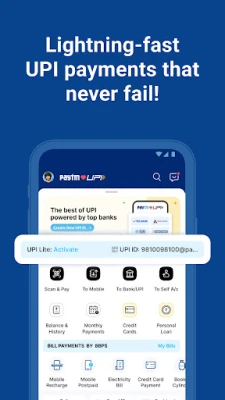

Welcome to the world of Paytm, where sending money to your friends and family is easier than ever before! With our app, you can now transfer money using your mobile number through Paytm UPI, even to those who are not on Paytm. Plus, you can also scan any QR code and make payments at various places like grocery stores, petrol pumps, and restaurants. And that's not all, you can also recharge your mobile and pay your utility bills such as electricity, gas, water, and broadband, all in one place. We are proud to announce that Paytm is now powered by top Indian banks including Axis Bank, HDFC Bank, SBI Bank, and Yes Bank. This ensures a seamless and secure banking experience for all our users. Our UPI payments are safe, reliable, and superfast, allowing you to enter your mobile number and transfer money to anyone using Paytm UPI. You can also check your bank account balance and view transaction history on our app. Your UPI ID is a unique ID used to make payments using the Unified Payment Interface (UPI). And to make sure your transactions are secure, we require you to set a UPI PIN, which can be a 4 or 6-digit number. But for those quick and easy payments of up to ₹4000 per day, you can use UPI Lite without having to enter a PIN. But that's not all, we also offer enhanced flexibility with the RuPay Credit Card, allowing you to make secure payments effortlessly. You can add your credit card on Paytm and pay at any shops without having to enter a CVV or OTP. This means hassle-free and safe payments without having to carry your credit cards everywhere. And the best part? You can earn rewards and cashbacks on all your Paytm payments. With Paytm, you can also make safe and contactless payments at offline stores by using our UPI Payments app, mobile number, or by scanning a QR code. And for all your online purchases, you can make payments at food delivery, grocery, shopping, and entertainment apps/sites, and over 100 other apps. But that's not all, we also make it easy for you to recharge your mobile, DTH, or pay your electricity, broadband, water bills, insurance premiums, E-Challan, loan EMI, and municipal tax. You can find the latest prepaid recharge plans and mobile recharge offers for Jio, Airtel, Vodafone Idea (VI), MTNL, and BSNL. And for those who use FASTag, you can also recharge it on our app. But that's not all, you can also order groceries, food, and home decor items on Paytm ONDC and get the best deals. And if you're planning to get a loan, you can check your credit score for free on our app. We also offer instant personal loans ranging from 50K to 25 lac, with a repayment period of 6-60 months and an annual interest rate of 10.99%-35%. Please note that personal loans are only available to Indian citizens within the territory of India. We have partnered with top lending partners such as Hero Fincorp Ltd, Aditya Birla Finance Ltd, TATA Capital, Poonawalla Fincorp, and SMFG to provide you with the best loan options. For example, if you take a loan amount of 100,000 with an interest rate of 23%, processing fee of 4.25%, and a tenure of 18 months, your loan processing fee would be Rs.4250, stamp duty charges would be applicable as per law, and your EMI per month would be Rs.6621. This means the total interest would be Rs.19178, and the disbursal amount would be Rs.94785, with the total amount payable being Rs.119186. And finally, you can also book tickets for trains, buses, and flights on our app. We are the authorized IRCTC partner for rail e-ticket booking, cancellation, PNR status, and live train status. So what are you waiting for? Download the Paytm app now and enjoy all these amazing features! And if you have any questions or concerns, please feel free to contact us at One 97 Communications Limited, One Skymark, Tower-D, Plot No. H-10B, Sector-98, Noida UP 201304 IN. Remember, Paytm Money Ltd. is a wholly owned subsidiary of One97 Communication Ltd. (Paytm) and is registered with SEBI and PFRDA as a stockbroker (INZ000240532) and e-pop (269042019) for NPS services.

Rate the App

User Reviews

Popular Apps

Editor's Choice