Latest Version

Version

5.237.0

5.237.0

Update

September 01, 2024

September 01, 2024

Developer

Chime

Chime

Categories

Finance

Finance

Platforms

Android

Android

Downloads

35

35

License

Free

Free

Package Name

com.onedebit.chime

com.onedebit.chime

Report

Report a Problem

Report a Problem

More About Chime – Mobile Banking

Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder.

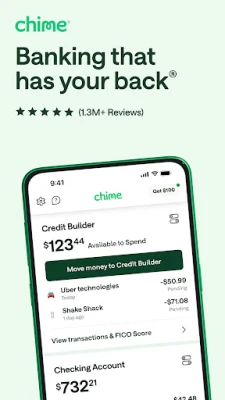

Hello everyone, today I am excited to review the Chime app, a financial technology company that offers banking services through The Bancorp Bank, N.A. or Stride Bank, N.A. With the Chime® Visa® Debit Card, issued by The Bancorp Bank, N.A. or Stride Bank, users can enjoy the convenience of making purchases anywhere Visa cards are accepted. And for those looking to build their credit, the secured Chime Credit Builder Visa® Credit Card is also available, with no credit check and no annual fees. Let's dive into the features of this app and see what makes it stand out from other banking apps.

First and foremost, Chime prioritizes the safety and security of its users' money. With instant transaction and daily balance alerts, users can stay in control of their finances and be notified of any suspicious activity. Additionally, the app offers two-factor authentication and the ability to block your card with just one tap, giving users peace of mind in case their card is lost or stolen.

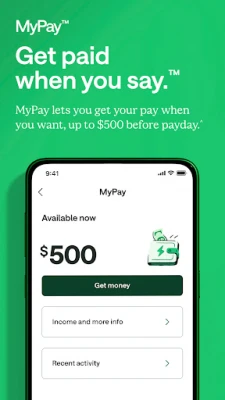

But that's not all, Chime also offers a unique feature called MyPay™, which allows users to access up to $500 of their pay any day they want, with no credit check, no interest, and no mandatory fees. Users can receive the funds for free within 24 hours or instantly for a small fee of $2 per advance. This feature is currently only available in certain states, so be sure to check the terms and conditions on the website for more details.

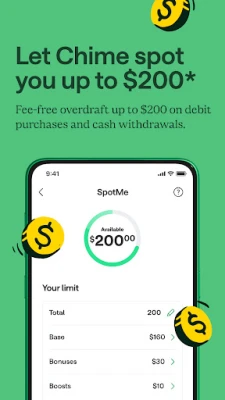

Another great feature of Chime is the ability to overdraft up to $200 on Chime debit card purchases and in-network ATM withdrawals, without any fees. This is a lifesaver for those moments when your balance is running low and you don't want to be hit with an overdraft fee. Eligible members on Chime can take advantage of this feature and avoid any unnecessary fees.

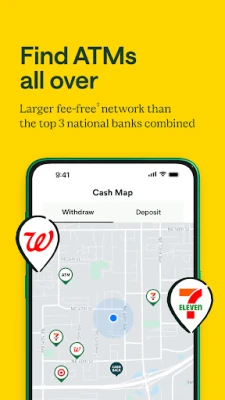

One of the biggest selling points of Chime is its commitment to no monthly fees, minimum balance fees, or foreign transaction fees. As they say, "Your Money Shouldn’t Cost Money.TM" Users can also access over 50,000 fee-free ATMs at popular locations like Walgreens, 7-Eleven, and CVS. This is a huge plus for those who travel frequently or live in areas with limited ATM options.

But what sets Chime apart from other banking apps is its Credit Builder feature. By using the Credit Builder card, users can increase their FICO® Score by an average of 30 points with regular on-time payments. And the best part? There are no interest charges, annual fees, or credit checks to apply. This is a great option for those looking to improve their credit score without any added fees or hassle.

Lastly, Chime allows users to send money to friends, family, or roommates with no transfer fees. This feature is as fast as sending a text and is a convenient way to split bills or pay someone back. And for those who need a little extra cash, Chime offers SpotMe® on Debit, which allows eligible users to overdraft up to $200 on debit card purchases and cash withdrawals.

In conclusion, Chime is a comprehensive and user-friendly banking app that offers a variety of features to help users manage their money. With its emphasis on safety, no fees, and unique features like MyPay and Credit Builder, Chime is definitely worth considering for your banking needs. So why not give it a try and see for yourself? Thank you for reading my review, and happy banking!

First and foremost, Chime prioritizes the safety and security of its users' money. With instant transaction and daily balance alerts, users can stay in control of their finances and be notified of any suspicious activity. Additionally, the app offers two-factor authentication and the ability to block your card with just one tap, giving users peace of mind in case their card is lost or stolen.

But that's not all, Chime also offers a unique feature called MyPay™, which allows users to access up to $500 of their pay any day they want, with no credit check, no interest, and no mandatory fees. Users can receive the funds for free within 24 hours or instantly for a small fee of $2 per advance. This feature is currently only available in certain states, so be sure to check the terms and conditions on the website for more details.

Another great feature of Chime is the ability to overdraft up to $200 on Chime debit card purchases and in-network ATM withdrawals, without any fees. This is a lifesaver for those moments when your balance is running low and you don't want to be hit with an overdraft fee. Eligible members on Chime can take advantage of this feature and avoid any unnecessary fees.

One of the biggest selling points of Chime is its commitment to no monthly fees, minimum balance fees, or foreign transaction fees. As they say, "Your Money Shouldn’t Cost Money.TM" Users can also access over 50,000 fee-free ATMs at popular locations like Walgreens, 7-Eleven, and CVS. This is a huge plus for those who travel frequently or live in areas with limited ATM options.

But what sets Chime apart from other banking apps is its Credit Builder feature. By using the Credit Builder card, users can increase their FICO® Score by an average of 30 points with regular on-time payments. And the best part? There are no interest charges, annual fees, or credit checks to apply. This is a great option for those looking to improve their credit score without any added fees or hassle.

Lastly, Chime allows users to send money to friends, family, or roommates with no transfer fees. This feature is as fast as sending a text and is a convenient way to split bills or pay someone back. And for those who need a little extra cash, Chime offers SpotMe® on Debit, which allows eligible users to overdraft up to $200 on debit card purchases and cash withdrawals.

In conclusion, Chime is a comprehensive and user-friendly banking app that offers a variety of features to help users manage their money. With its emphasis on safety, no fees, and unique features like MyPay and Credit Builder, Chime is definitely worth considering for your banking needs. So why not give it a try and see for yourself? Thank you for reading my review, and happy banking!

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Solitaire Grand HarvestSupertreat - A Playtika Studio

InstagramInstagram

Free Fire MAX 5Garena International I

Blackout Bingo - Win Real CashLive Bingo for Real Cash Prize

FacebookMeta Platforms, Inc.

Play 21Skillz® Real Money Card Game

Solitaire Cube - Win Real CashClassic Klondike Card Game

Cricket LeagueMiniclip.com

WhatsApp MessengerWhatsApp LLC

5-Hand PokerSkillz® Real Money Card Game

More »

Editor's Choice

Blackout Slots: Skill ReelsReal Cash Prize Fun

Big Buck Hunter: MarksmanHunt Deer & Win Cash Prizes!

Dominoes Gold - Domino GamePlay Dominoes for Real Money

Pool Payday: 8 Ball Pool GamePlay Billiards For Real Cash

Strike! By BowleroBowl for Real Prizes!

5-Hand PokerSkillz® Real Money Card Game

Play 21Skillz® Real Money Card Game

21 Blitz - Blackjack for CashWin Real Money with Real Skill

Blackout Bingo - Win Real CashLive Bingo for Real Cash Prize

Solitaire Cube - Win Real CashClassic Klondike Card Game